Friday, June 12, 2020

What I like about TransferWise : GDPR compiant, Zero foreign or international transaction fee debit Mastercard and Link it to PayPal

✅ The real GDPR compliant

Friday, May 1, 2020

What I like about using OrbitRemit. It's about privacy (GDPR Compliance)

What I like about using OrbitRemit

- If you make your remittance in the morning you can expect it to be in your recipient’s bank account on the same day.

- Aside from speed, exchange rate, usability, it's privacy! It's GDPR compliant according to their support!

Although it is nowhere to be found on their website, I did due diligence and contacted their support to confirm.

According to OrbitRemit support, as a company registered in NZ, Australia and the UK, they comply with the privacy regulations of these countries and as per their terms and conditions, they value the privacy of our customers.

In the UK or EU, when it’s about privacy you talk about (GDPR Compliance)

Please refer to their terms and conditions for further information. https://www.orbitremit.com/legal/privacy-policy

After reading their privacy policy, in reference to GDPR compliance, these are your information rights on your personal data.

You have certain rights relating to:

1. Right to access: the right to request copies of your personal information from us;

2. Right to correct: the right to have your personal information rectified if it is inaccurate or incomplete;

3. Right to erase: the right to request that we delete or remove your personal information from our systems;

4. Right to restrict our use of your information: the right to 'block' us from using your personal information or limit the way in which we can use it;

5. Right to data portability: the right to request that we move, copy or transfer your personal information;

6. Right to object: the right to object to our use of your personal information including where we use it for our legitimate interests, or where we use your personal information to carry out profiling to inform our market research and user demographics. If you raise an objection we will stop processing your personal information unless very exceptional circumstances apply, in which case we will let you know why we're continuing to process your personal information.

That's 6/8 boxes ticked. (see -- https://ico.org.uk/for-organisations/guide-to-data-protection/guide-to-the-general-data-protection-regulation-gdpr/individual-rights/)

Weighing up the competition

There are plenty of companies that process international remittances

But what makes them different? How do you know which is the best one? Let’s compare a number of the most well known remittance services and see which ones stand out in terms of fees, rates, security, transfer times, and satisfaction. That way, you can make sure you’re getting the best deal when you send money abroad.Monday, March 30, 2020

My first investments in CommSec Pocket

My first investments in CommSec Pocket

Well, the markets are down but so is the AUD. It is time to invest in the sharemarket.

I have chosen IOZ and NQD and soon SYI

about CommSec Pocket App (source CBA)

An app so simple, it turns a non-investor into an investor

You can start investing with as little as $50, and gradually build a portfolio over time. Choose from 7 themed investment options and invest in something that appeals to you, like tech, sustainability leaders, or the biggest 200 companies on the Aussie market. We’ll help you along the way with bite-sized tips, videos, and articles to teach you all about the share market.

How it works

When you invest via CommSec Pocket, you’ll be buying units in an Exchange Traded Fund (ETF). ETFs are funds that trade on a stock exchange, just like shares – the difference is that an ETF represents an investment in a selection of companies and assets, while a share represents an investment in just one company. One ETF can give you exposure to a whole diverse portfolio.

Every ETF in CommSec Pocket has a theme. See below for all the options you can choose from, covering different industries, markets or countries.

Investment options

Invest in something that matters to you, with 7 options to choose from:

Benefits

Simplified investing, anytime, anywhere.

Brokerage

When you trade through the app, you’ll pay $2 each time you invest or sell up to $1,000.

Trades over $1,000 are charged at 0.20% of the trade value. For example, a $1,100 trade will cost you $2.20 ($1,100 x 0.20%)

Zero account keeping fees

It costs nothing to have an account. Ever.

Late settlement fee

Cash is debited from your account 2 business days after your trade is done. This is when your trade settles. If there are insufficient funds when we debit, you’ll be charged a $10 Late Settlement Fee.

ETF management fee

Each ETF provider charges a management fee for providing the ETF to investors. The fee ranges from 0.09% to 0.67% of your investment per year depending on the ETF. It’s not an out-of-pocket fee. Rather, it’s deducted from the ETF’s unit price. The fee is shown when you browse the investments. The fee is charged by the ETF provider, not by CommSec.

Supplementary services

Fees apply for supplementary services. For more info, see our Financial Services Guide.

Per discussion in Whirlpool forums, here are the expense ratios

Aussie Top 200 – iShares Core S&P/ASX 200 ETF – IOZ 0.09%

Aussie Dividends – SPDR MSCI Australia High Dividend Yield Fund – SYI 0.35%

Global 100 – iShares Global 100 ETF – IOO 0.40%

Emerging Markets – iShares MSCI Emerging Markets ETF – IEM 0.67%

Health Wise iShares Global Healthcare ETF = IXJ 0.47%

Sustainability Leaders – BetaShares Global Sustainability Leaders – ETHI 0.57%

Tech Savvy – BetaShares NASDAQ 100 – NDQ 0.48%

Aussie Dividends – SPDR MSCI Australia High Dividend Yield Fund – SYI 0.35%

Global 100 – iShares Global 100 ETF – IOO 0.40%

Emerging Markets – iShares MSCI Emerging Markets ETF – IEM 0.67%

Health Wise iShares Global Healthcare ETF = IXJ 0.47%

Sustainability Leaders – BetaShares Global Sustainability Leaders – ETHI 0.57%

Tech Savvy – BetaShares NASDAQ 100 – NDQ 0.48%

How do take advantage of this app and how to do investing?

To borrow the words of 'blueka' member of Whirlpool:

If you choose to invest lets say $1000pw then you're going to be paying $104 in brokerage in 1 year. You'll have $52,000 invested.

What are your alternatives to invest $52,000?

You could do $26,000 semi-annually and pay a total of $62.40 in brokerage.However, you will miss out on returns having $0 invested for 6 months, and similarly missing out of $0-$25000 for the other 6 months, which in all probability will be higher than the $41.60 you save in brokerage costs.

The CommSec App is a tool that is handy and mobile; making you able to react and invest immediately. Remember that in investing, time is valuable. Make it Count!

Going physically to Filipino Stores to do remittance to loved ones to Philippines is dead. It is for oldies! :)

Going physically to Filipino Stores to do remittance to loved ones overseas is dead. It is very primitive and

It is for oldies! :)

... and now, specially during times like this CORONA virus period, you can transfer money online.

and I use OrbitRemit for that purpose!

I’ve been using OrbitRemit to send money abroad. It’s really easy, you can do everything online and it’s up to 80% cheaper than using the bank! Sign up now and make it count with a free payment:

Sunday, March 29, 2020

Working from home this time of the virus period? You can save electricity by simply changing your tariff rate. But which type of tariff is right for you?

Working from home this time of the virus period?

You can save electricity by simply changing your tariff rate.

But which type of tariff is right for you?

A tariff is the way you get charged for your energy.

Choosing the right tariff for you can help reduce what you pay for your energy.

To help you work out what’s best for you, we’ll explain:

- what the different tariffs are, and

- how they work.

Electricity tariffs

There are three types of electricity tariffs:

There are three types of electricity tariffs:

- single rate, time of use, controlled load, and demand

With single rate tariff plan there are no peak or off-peak periods. This means that you pay the same rate whatever time of day you use energy.

The rate is usually lower than the peak rates of a time of use tariff. This means a single rate plan could be a good choice if:

- You are at home a lot in the evening Monday to Friday.

- You need to use your appliances more Monday to Friday, like your washing machine or dishwasher.

Single rate tariffs are sometimes called:

- flat rate

- standard rate

- anytime rate, or

- peak rate. READ MORE in

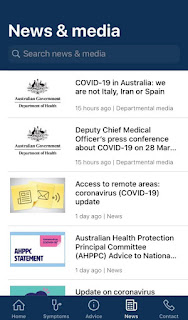

The Australian Government has released an official app with the information you need to know about #Coronavirus #COVID19

The Australian Government has released an official app with the information you need to know about #Coronavirus #COVID19.

Search “Coronavirus Australia” in the Apple App Store and on Google Play.

Subscribe to:

Posts (Atom)